Have you ever considered starting your own commission-based business but hesitated due to high investment costs or the fear of failure? If so, you’re not alone—many aspiring entrepreneurs share the same concerns. But what if there was a way to earn a significant income without the burden of hefty investments or major risks?

Welcome to the commission-based business model—an opportunity that has helped millions in India build a steady income with minimal upfront costs. From AEPS (Aadhaar Enabled Payment System) to affiliate marketing, this model offers a wide range of flexible and highly profitable opportunities.

In this blog, we’ll break down everything you need to know about commission-based businesses, including how they work, the different opportunities available, potential earnings, and how platforms like UseToPay can help you get started with ease. Ready to explore? Let’s get started!

Understanding Commission-Based Businesses

Definition and Concept

A commission-based business enables individuals to earn income by promoting or facilitating the sale of a company’s products or services. Each successful sale or transaction results in a commission payout.

This model is ideal for those seeking flexibility, minimal startup costs, and unlimited earning potential. It is particularly popular in India, where the rise of digital services and financial inclusion initiatives like AEPS is creating new opportunities for entrepreneurs.

The Rising Popularity of Commission-Based Businesses in India

Minimal Financial Risk

Commission-based work requires little to no upfront investment, making them ideal for beginners and entrepreneurs looking for low-risk opportunities.

Booming Digital Landscape

India’s rapid digital transformation has paved the way for online transactions, financial services, and digital payments, making commission agent business opportunities more accessible.

Lucrative Earning Potential

With the right strategies, individuals can generate a steady stream of income, earning commissions on every successful transaction.

Community-Centric Approach

Many commission-based businesses, such as AEPS and bill payments, provide essential services to local communities, making them highly rewarding.

Government Support and Initiatives

Various government programs, such as Digital India and financial inclusion initiatives, have further boosted the demand for commission-based work in financial services.

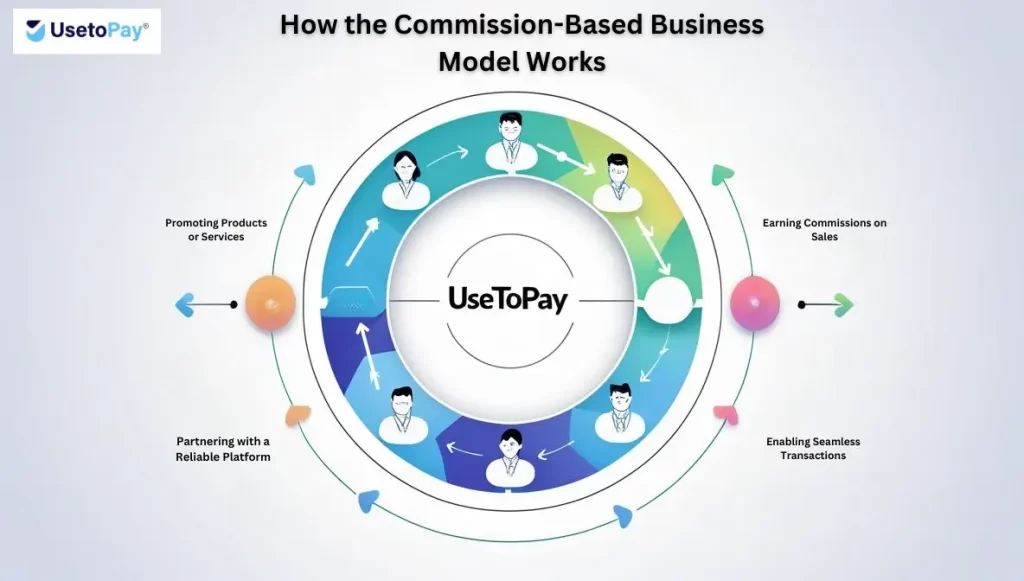

How the Commission-Based Business Model Works

Partnering with a Reliable Platform

Choosing the right platform, such as UseToPay, is crucial to accessing high-commission opportunities and a trusted payment ecosystem.

Promoting Products or Services

Individuals can market their services online, through word-of-mouth, or by leveraging social media to attract customers.

Enabling Seamless Transactions

Commission based businesses revolve around facilitating smooth and secure transactions for customers.

Earning Commissions on Sales

The more transactions processed, the higher the commission earned, creating an excellent source of passive income.

Best Commission-Based Business Opportunities in India

1. Aadhaar Enabled Payment System (AEPS) Business

Earn Commission by Offering Banking Services

AEPS enables cash withdrawals, balance checks, and fund transfers using Aadhaar-based authentication. With UseToPay AEPS, you can:

- Earn commissions on every transaction

- Offer essential banking services in rural and urban areas

- Start with minimal investment using a biometric device & smartphone

How Much Can You Earn?

- ₹5 to ₹25 per withdrawal transaction

- Commission on balance inquiry & mini statements

Who Can Start?

Retailers, shop owners, and individuals looking to offer financial services.

2. Mobile & DTH Recharge Business

Earn High Commission on Every Recharge

India has over a billion mobile users, making mobile recharges a highly profitable commission-based business. UseToPay Recharge API allows you to:

- Provide prepaid & postpaid mobile recharges for Airtel, Jio, Vi, BSNL

- Earn commissions on every recharge instantly

- Offer DTH recharge services for Tata Play, Dish TV, Airtel DTH

How Much Can You Earn?

- ₹2 to ₹10 per recharge

- Higher earnings with bulk recharges

Who Can Start?

Retailers, shopkeepers, and home-based workers.

3. Bill Payment & Utility Services (BBPS Business)

Earn by Helping People Pay Their Bills

UseToPay BBPS allows individuals to offer bill payment services for electricity, water, gas, broadband, and more.

How Much Can You Earn?

- ₹5 to ₹20 per bill payment

Who Can Start?

Retailers, shop owners, and entrepreneurs providing financial services.

4. Domestic Money Transfer (DMT) Business

Earn by Facilitating Instant Money Transfers

UseToPay DMT enables agents to help customers send money nationwide.

How Much Can You Earn?

- ₹5 to ₹50 per transaction

Who Can Start?

Retailers, shopkeepers, and financial agents.

5. Insurance Agent & Policy Sales Business

Earn High Commissions by Selling Insurance

With UseToPay Insurance Services, agents can sell:

- Life Insurance (LIC, HDFC Life, SBI Life)

- Health Insurance (Star Health, ICICI Lombard)

- Motor Insurance (Reliance General, Bajaj Allianz)

How Much Can You Earn?

- Up to 30% commission per policy

- Lifetime renewal commissions on select policies

| Business Type | Commission Rate | Monthly Earnings (Approx.) |

| AEPS Services | ₹5 per transaction | ₹5,000 to ₹15,000 |

| Insurance Sales | 15%-35% of policy premium | ₹20,000 to ₹1,00,000+ |

| Affiliate Marketing | Up to 10% of product price | ₹10,000 to ₹50,000 |

| Real Estate Broking | 2% of property value | ₹50,000 to ₹1,50,000+ |

| Travel & Tourism | 5%-15% of package price | ₹15,000 to ₹60,000 |

Steps to Launch Your Own Commission-Based Business

- Finding the Right Niche – Choose a business opportunity that aligns with your interests and skills.

- Choosing a Suitable Platform – Partner with a reliable service provider like UseToPay.

- Gaining Knowledge and Skills – Understand the products/services you are selling.

- Expanding Your Network – Build relationships with potential customers and partners.

- Tracking Performance and Growth – Monitor sales and optimize strategies for better earnings.

Key Advantages of Commission-Based Businesses

- No Initial Investment Needed – Start earning with little to no capital.

- Work on Your Own Schedule – Flexible working hours.

- No Earnings Limitations – Your income grows with effort.

- Enhance Your Skills – Develop marketing, sales, and networking skills.

- Contribute to Community Growth – Provide essential financial services to underserved areas.

Overcoming Common Challenges in Commission-Based Businesses

- Establishing Credibility – Build trust through excellent service and transparency.

- Gaining In-Depth Product Knowledge – Stay updated on products and services for better sales.

- Scaling and Expanding Successfully – Focus on customer retention and business growth.

Conclusion

Commission-based businesses provide an excellent opportunity for individuals looking to earn without heavy investment. With platforms like UseToPay, the process becomes even more streamlined, allowing users to maximize their earnings with minimal effort. Whether you’re an entrepreneur, freelancer, or looking for a side income, commission-based businesses are a gateway to financial freedom.

Frequently Asked Questions (FAQs)

Ans.A commission-based business allows individuals to earn money by selling products or services without owning them. You receive a commission for each successful transaction.

Ans.UseToPay provides a secure platform where users can partner with service providers, track their commissions, and withdraw earnings conveniently.

Ans. No, UseToPay allows you to start without any initial investment. You simply promote services and earn commissions on successful transactions.

Ans. Earnings depend on the number of successful referrals or sales you generate. The more effort you put in, the higher your potential income.

Ans. Yes, UseToPay ensures secure transactions, real-time tracking, and reliable payment processing for all users.